Introducing the next phase of upgrades to our WooCommerce payment gateway plugins.

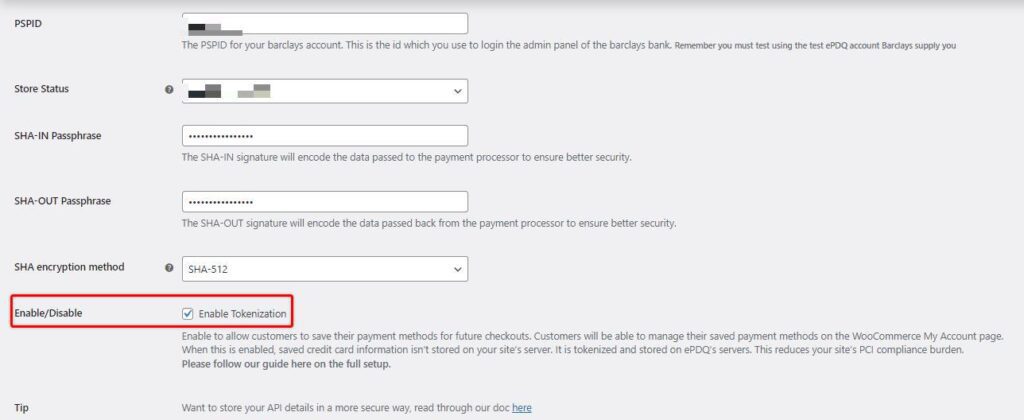

After thorough testing and development we have launched the first of our plugins upgraded to include tokenization. The Barclays ePDQ payment gateway (Barclaycard) for WooCommerce plugin and the First Data Connect for WooCommerce plugin now include the option to allow your customers to store their payment details securely for easier repeat ordering. For current license holders, the tokenization feature will be available when you next update your plugin.

It can be so useful when you go to buy something from your favourite online stores, knowing that your bank details are waiting for you. No typing in of long numbers, just your security code. What’s even better is knowing that you can do this with your credentials and bank information remaining safe and secure, being processed through 3D security.

Tokenization offers just that and We are AG are now working to include the option to implement this straight into your WooCommerce website. The Barclays ePDQ payment gateway (Barclaycard) for WooCommerce and First Data Connect for WooCommerce plugins are available right now, with the others following over the next few months, with all the testing and documentation required for each.

So what is tokenization?

Tokenization is a data security process that takes sensitive data (such as bank information) and generates a token consisting of random characters. This can then be used as a reference to locate the original data that is encrypted and stored.

WooCommerce payment gateway plugins can use this technology to enable your online store to protect customers’ bank information for payments. The merchant only has access to the token for the payment itself, never the customer’s card details.

Payment gateways store the more traditionally encrypted data securely at their end. Your store utilises token technology to complete transactions. Meanwhile, the customer experiences an efficient and accessible way to pay.

Is it safe?

While it may sound similar, unlike encryption tokenization offers no key or algorithmic processes (that may be reverse-engineered). Instead, the tokenization process uses a ‘token vault’, a secure database, which stores the information that understands the relationship between credentials and the token.

This process is far more secure as while tokens can be used to reference the original data, it cannot be abused to guess (or brute force) access to the data. With tokens possessing no mathematical relation to the data, there is no process that can be reversed to decrypt the secured string.

What are the benefits?

Customer Experience

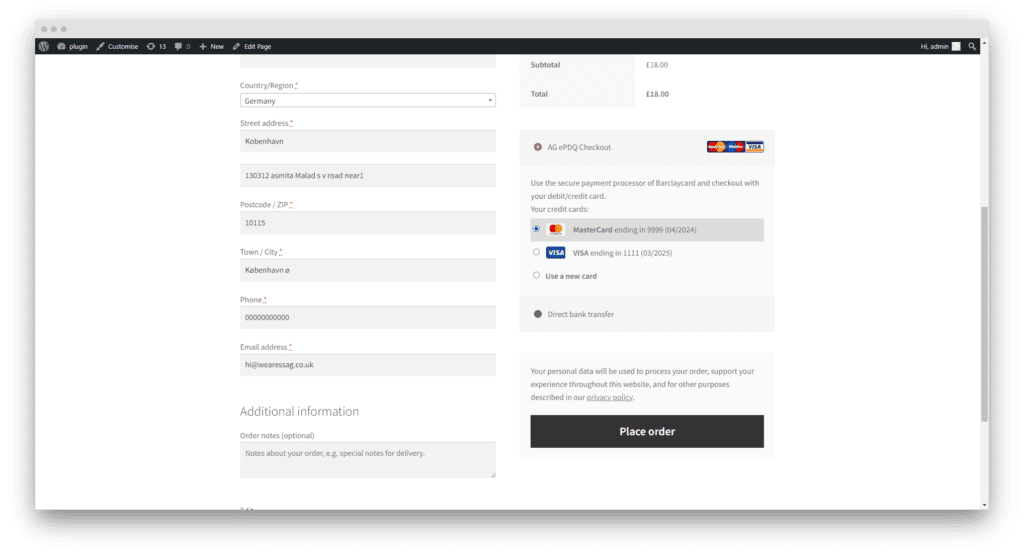

The usage of tokens is customer-friendly, providing them with an easier shopping experience as they don’t need to enter their details with each purchase.

Beyond ease of access, if a store is compromised, hackers would not gain any sensitive data. Storing bank credentials for online shopping was previously considered irresponsible. Nowadays tokenization offers customers extra security with every store it is utilised on as no two tokens for any card are the same.

Compliance Standards

While “tokenization solutions do not eliminate the need to maintain and validate PCI DSS compliance, but they may simplify a merchant’s validation efforts by reducing the number of system components for which PCI DSS requirements apply.” As stated by the PCI Security Standards Council in their own guidelines.

Flexible Tech

The option for tokenization can be turned off (and back on!) from your website dashboard.

Tokenization is more flexible than simply encrypting data. One good example of tokenization’s flexibility is the ability to display the last four numbers of a bank card. As the merchant never accesses the whole card number, hence why it is often displayed as asterisks, instead it uses a token that provides the four digits so the customer sees the reference of their own account.

And of course your customers can choose to remove their stored card details at any time.

How can I use Tokenization?

The Barclays ePDQ payment gateway (Barclaycard) for WooCommerce and First Data Connect for WooCommerce plugins allow you to integrate the payment gateway systems into your WooCommerce store. This will offer you all the benefits already highlighted as well as other useful features such as:

- Process refunds directly in your WooCommerce admin panel.

- AG Status Check – automatically or manually check the status of an order from within your website.

- Translation ready, compatible with WPML and other translation tools.

Barclays ePDQ (Barclaycard) and First Data Connect are the first of our payment gateway plugins we have rolled out and offer a compatible and comprehensive addition to your WooCommerce store. We are AG will bring you further tokenization options for your WordPress WooCommerce website over the next few months.

Be sure to check back soon, now that you understand why you might want tokenization from your payment gateway plugins.